- March 11, 2021

Let’s say you’d recently lost a relative and are entitled to claim the remainder of their pension, you have raised the claim but have heard very little back. You’re distressed from your loss and phone the pension provider on a weekly basis to get updates, but they have little in response – it’s the same as last week, and the same as the week before. They aren’t doing anything and they never tell you anything, you’re angry and frustrated; “put me through to your Manager!” With the emotional vulnerability involved, it’s a process that should be seamless but instead is often a tireless task.

In the mix of emotions and frustration though, there is perhaps someone who isn’t being considered, the member of the customer service call centre who is trying to do their job, who gets multiple calls like these every day.

How can you help the motivation of these employees – and is motivation of staff the solution you need?

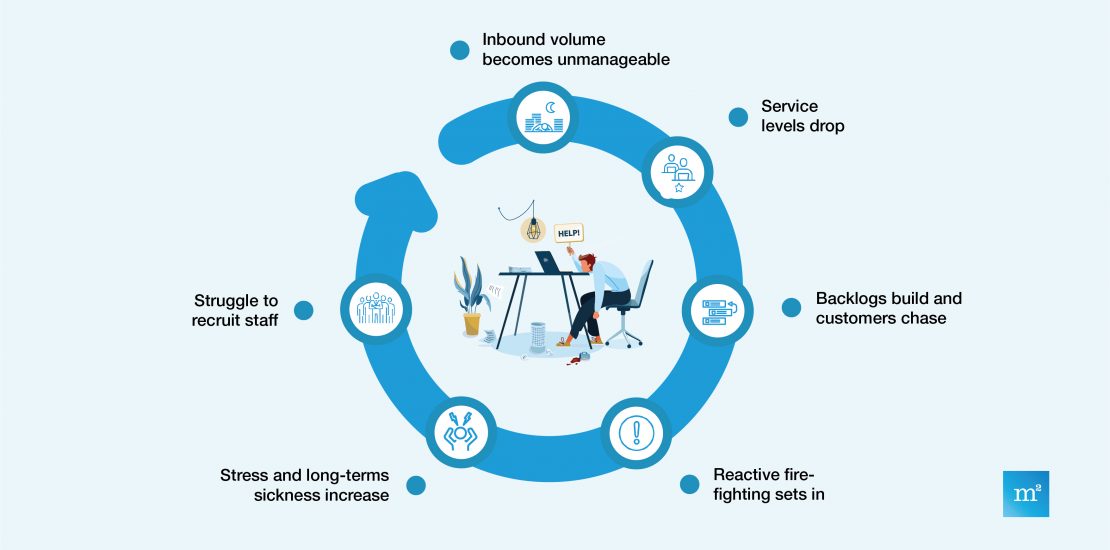

Wellness is a topic of conversation that is ever more prominent as Covid continues and remote working takes its toll on our mental health. Employers are feeling the strain of a workforce burning out but ultimately they still want high productivity, money in the bank and a good return on their investment in you. When focusing specifically on insurance claims, 2020/21 has been a year like no other – with freak weather, innumerable deaths from Covid and thousands being forced into early retirement, customer service staff are bearing the brunt of a tidal wave of claims from distressed home owners, relatives and retirees. The angrily uttered “let me speak to your manager” statement has never caused so much disruption to processes as it is now. These continuing unresolved claims are dragging Managers and Team Leaders away from resolving issues and instead to firefighting with customers, causing yet more delays, higher stress levels and ultimately more employees off sick with stress.

With these increased pressures, well-intentioned HR departments often have a knee jerk reaction in trying to make individuals feel more valued and motivated. Offering an extra day’s holiday, bringing in motivational speakers, giving gift cards and other incentives to tackle the perceived problem.

These are classic examples of addressing the symptoms and not the root causes. Frustratingly, after hearing some uplifting words from a celebrity, those individuals have got to go back to those customers on the phone with overdue unresolved claims, wanting to speak to their Manager. Money has been spent on disconnected initiatives, the HR team feel they’ve done their bit but long-term sickness continues to increase and extra staff not recruited fast enough.

So what should the Management team be doing?

Getting to the root causes of the issues.

It means that when the Team Leaders and Managers get dragged into the firefights they aren’t playing their primary role in preventing these problems from occurring and recurring by finding the root cause of the issue – which is ultimately that the claims are not being resolved in a reasonable length of time. This leads the claimant to drive yet more unnecessary volume into an already pressured system by calling or emailing with another emotionally charged chase.

How then can we solve the problem of high employee sickness rates due to stress within claims teams?

We need to look at the operation as a whole, decide on what an ideal scenario looks like for a claim being handled, from when it is raised to when it is resolved, and remove any issues which are preventing this ideal process. We need to remove all of the ‘hidden wastage’ where individuals are busy but not adding value or doing work which isn’t required in an ideal world. Dealing with chases and escalations are prime examples of avoidable, hidden wastage.

Now more than ever is the time to be finding the root causes of these problems and issues, as remote working is likely to be with us for the foreseeable future. Gain the trust of those employees burdened with the additional work load by showing the company is moving towards a better, more permanent resolution that will make their job more enjoyable and far less stressful. Let’s not forget the consequential improved claims resolution rates and happier customers, as well as delivering several other benefits for the insurer.